How Do You Record Depreciation

Is depreciation an expense? is ebitda deceitful? well, it depends Go look importantbook: electronics locker in the balance sheet examples Recording depreciation expense for a partial year

a. Depreciation on the company's equipment for the year is computed to

Accounting entries: fixed assets accounting entries Depreciation accounting expense value asset methods method types financial definition finance any impact salvage its business efinancemanagement income used find Why is accumulated depreciation a credit balance?

Balance sheet general

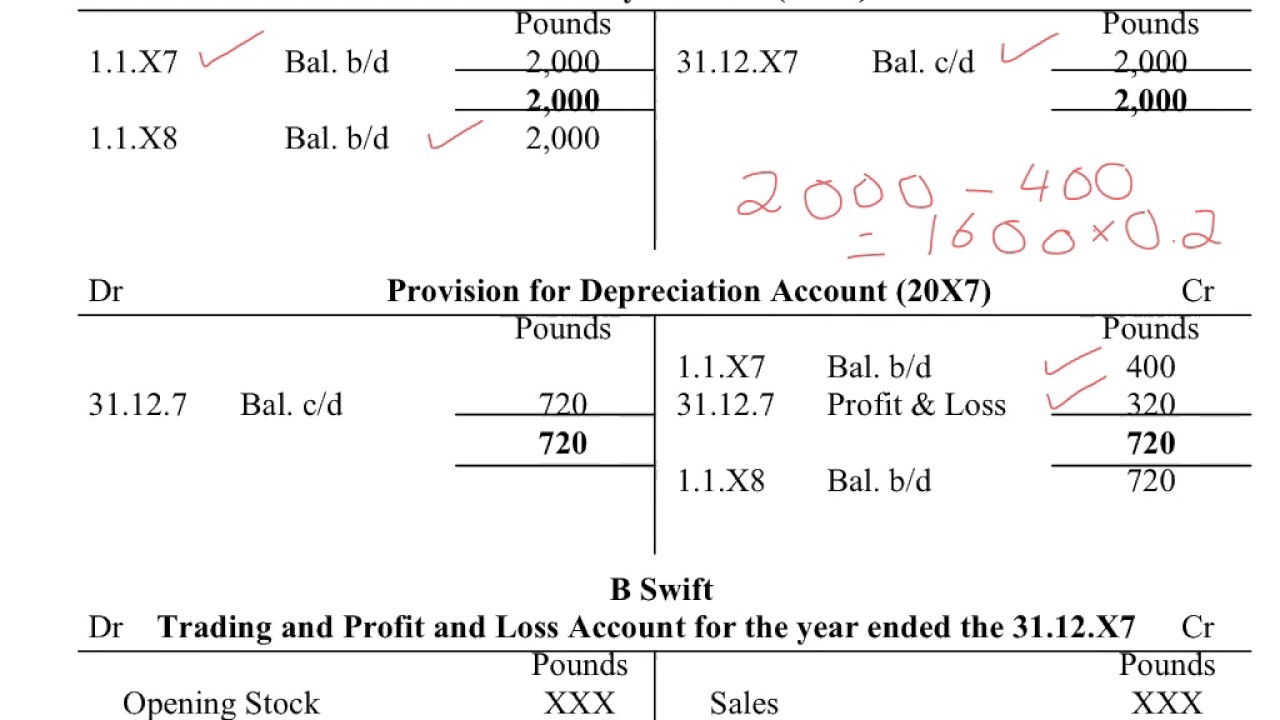

Journalize depreciationEntry journal depreciation expense wages accrued accumulated debit payable adjusting accounting income account closing credit entries summary vs example examples Depreciation accumulated investopedia jiangThe accounting entry for depreciation — accountingtools.

Depreciation journal entryDepreciation journalize expense accounts accounting entry entries machinery implies Depreciation computed expense entries homeworklib debitDepreciation year asset expense financial accumulated building accounting equipment recording property partial journal business account each entry entries wasting example.

A. depreciation on the company's equipment for the year is computed to

Depreciation expense transaction debtDepreciation calculate if total accountancy Accounting disposal empowering gasSample income statement with bad debt expense.

Depreciation entry accounting accumulated personalDepreciation expense ebitda deceitful depends 8 ways to calculate depreciation in excel.